It is unnecessary to copy information from your original return. Third, you can amend this year’s return only with this year’s version of TurboTax. If you eFiled your return on, we will have already done the math correctly for you and made sure you had the proper forms filled out.

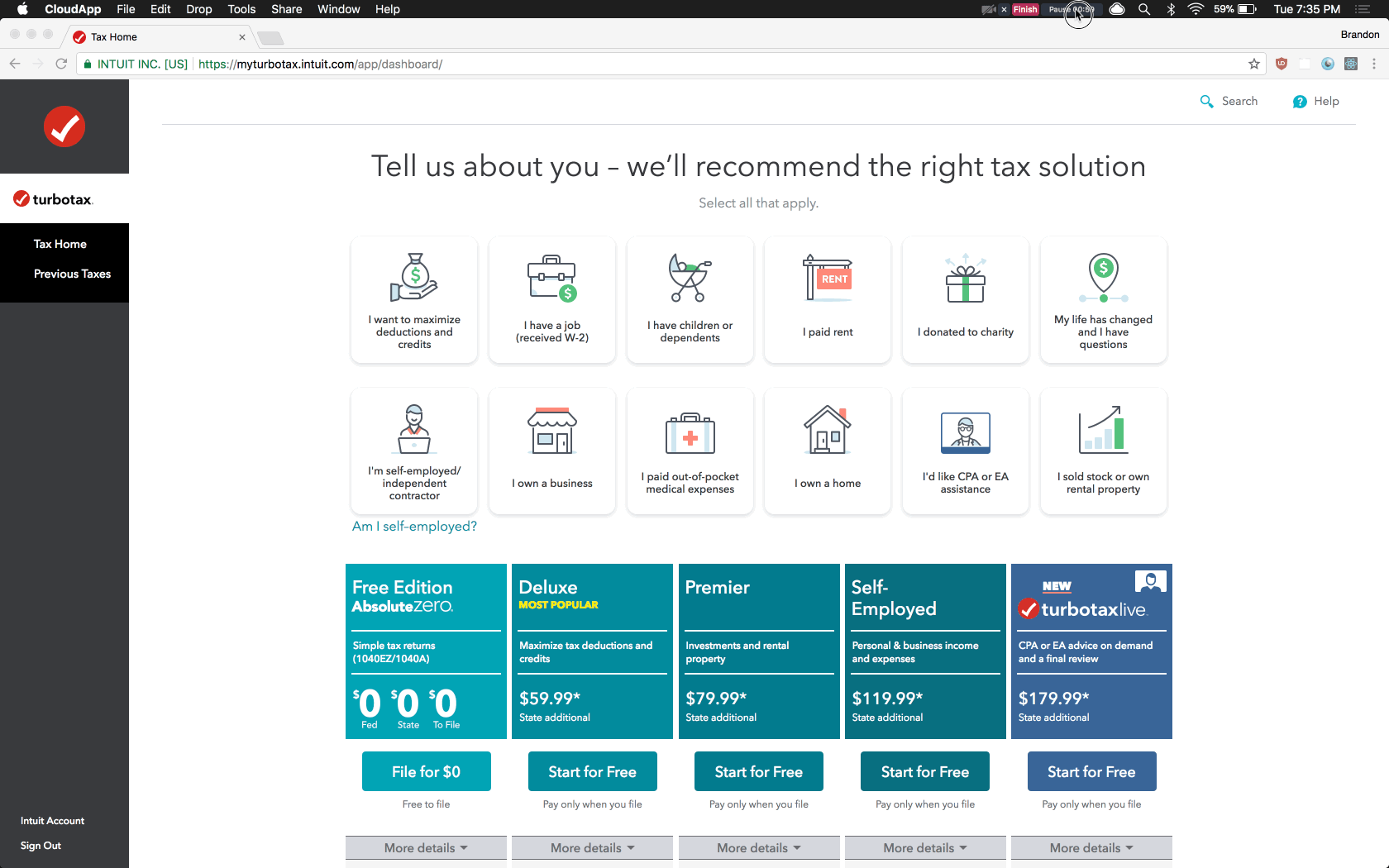

Turbotax review of 2017 filing free#

It’s free to start, and enjoy $15 off TurboTax Premier when you file. Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier is designed for you. Even at this point, the manager of the audit group who receives your return will review it one last time to insure that it’s worthy of an audit. Individual Income Tax Return, and follow the instructions. If the program picks up on something out of the ordinary-your return is flagged. The IRS first uses a computer program to compare the information on your return to a random sample of returns from similar taxpayers. Whenever someone files an original or amended tax return, the same audit selection process prevails. Understanding a little bit about how the IRS chooses tax returns for audit may provide you with a little more comfort. The statute of limitations prohibits you from filing an amendment that increases a refund amount beyond three years of the original filing date or two years of the date you actually pay the tax. Before you begin the process of amending a personal income tax return, you should first make sure that filing an amended return isn’t time barred by the statute of limitations. When you file with TurboTax, our calculations are guaranteed to be 100% accurate. Once your amended return has been processed, you will receive any additional refund you are owed. It generally takes the IRS 16 weeks to process an amended return, so you should wait at least 12 weeks before checking on the status of your new amended tax refund. Refunds are forfeit after 3 years, but tax debts stay on the IRS books for a minimum of 10 years. If you owe taxes, you should file an amended return even if 3 years have passed. If you owe taxes as a result of your amendment, you should file your amendment and make your tax payment as soon as possibleto avoid further penalties and interest. If you have more questions about tax amendments, please contact. Sign each amended return and mail each one in a separate envelope to the IRS. Make sure that you enter the correct Tax Year at the top of each 1040-X form. You can file more than one amendment but if you file two or more amendments at the same time, you should use a different Form 1040-X for each Tax Year. See the instructions for the form you originally filed (Form IT-201 or Form IT-203) to determine which form to file when amending your return (Form IT-201-X or IT-203-X). If you need to amend a tax return you filed with TurboTax, go to our website at and click on the Support tab for instructions. As long as you accurately report your income, deductions, filing status or only make mistakes that are inadvertent, you have nothing to worry about. In the event you are chosen for a tax audit, remember that it’s merely a review of your return. Only when this manager determines your return should be audited, will you be hearing from an IRS representative.

For example, if you file the amended tax return to increase your refund by adding the charitable contribution deduction you omitted, it may also reduce your state tax if it also allows for charitable deductions.

Therefore, changes you make to your federal return are likely to affect your state return. Most states calculate taxable income based on information you provide on your federal return. You have a limited amount of time to file an amended tax return otherwise, the IRS will not accept it for a refund of tax. The form also provides you with space to explain your reasons for filing the amendment. All prior tax years or back taxes can no longer claim tax refunds via a tax amendment. As of 2021, the deadline for 2017 tax year tax returns that result in an increased tax refund based on a tax amendment will be April 15, 2021. After 3 years, you can no longer claim a refund, and the money goes to the government. In order to claim a tax refund, a tax amendment has to be filed within 3 years you filed the original tax return, or within 2 years of the date you paid the tax, whichever is later. If you are due a refund from your current year tax return, the IRS states that generally you should wait until you receive your refund before filing your amendment if you are claiming an additional refund. Well Help You Make Corrections Or Updates To Your Irs Accepted 2019 Tax Return.

0 kommentar(er)

0 kommentar(er)